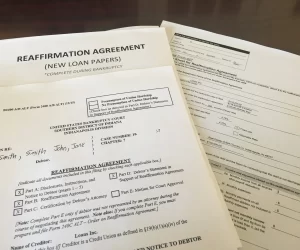

Filing Bankruptcy in Arizona

Potential clients frequently ask whether filing bankruptcy in Arizona is their best option. Before filing, you also must understand the differences between Chapter 7 and Chapter 13. If you are considering bankruptcy, always consult with an experienced Arizona bankruptcy lawyer prior to making any decisions. Every person’s situation is different.