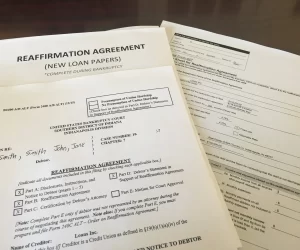

A Reaffirmation Agreement in Bankruptcy

A reaffirmation agreement in bankruptcy is a form agreement between a debtor and a secured creditor, such as a vehicle lender. The debtor agrees to pay back a specific debt even after bankruptcy. In return, the creditor promises not to repossess the collateral associated with that debt so long as the debtor stays current with payments. Reaffirmation agreements are available in Chapter 7, not Chapter 13. They are primarily used for secured vehicle loans, not mortgages.